Open banking is the process of sharing financial data with third-party financial services providers. Big banks and financial institutions usually share their customer data using application programming interfaces (APIs).

This open technology is considered as the future of the financial industry. It allows tech-savvy companies to offer an array of financial services tailored to consumers based on their financial habits.

As of 2020, around 24.7 million individuals are using open banking services. This figure is estimated to grow at a pace of 50% annually, reaching 132.2 million by 2024. Europe is the dominant market, followed by China and North America.

However, this financial technology can still seem foreign. Let us answer your questions, especially how open banking works, its safety, data privacy, law compliance, and many more.

The Inner Workings of Open Baking

The legacy banking industry stores heaps of data, including customers’ personal and financial data. However, traditional banks lack product and technological innovation when compared to the evolving fintech.

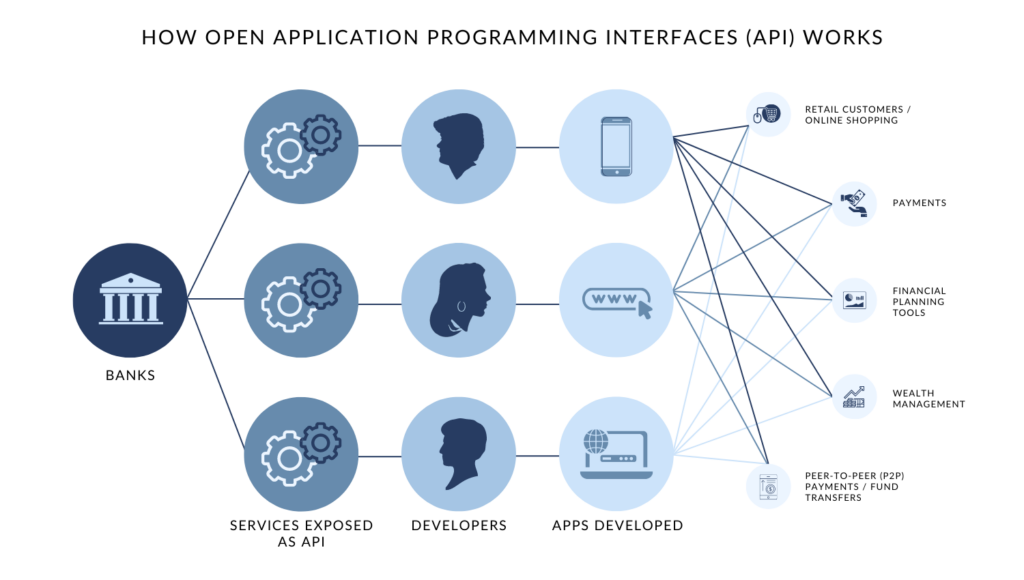

Open banking provides access to all these banking data to third-party platforms. The technology companies can then use these data to develop innovative financial services. It is technically implemented through a concept called banking-as-a-service.

The two key steps of open banking are:

- Banks providing access to customer data

- FinTech building innovative and tailored services based on the data

This open technology is used by fintech platforms in retail sectors, payments, financial planning tools, wealth management, and many more. It has an abundance of application in the real world.

The data under the open banking concept is mostly shared through APIs. These data are made available to the developers of any third-party platforms.

These data used by developers can be broadly classified into three categories:

- Account data (induces account holder’s name, account type, transaction information, etc.)

- Product data (information on products and services of a banking platform)

- Payment initiation (permission for making payment transactions)

Regulations Around Open Banking

The banking industry has always been subject to tight regulatory scrutiny. When it comes to sharing customer data, the regulations are more stringent.

In most well-regulated jurisdictions, customer consent is a must before sharing their data with any third-party service providers. Banks and financial institutions usually include the data sharing clause in the terms of their contract with the customer.

Legislators and lawmakers around the world are also pushing for the adoption of open banking. Europe, the United Kingdom, the United States, and almost all other developed markets have brought laws to promote the open sharing of financial data.

These regulatory oversights also make the open technology very safe. It is considered as secure as using the banks’ own online banking services.

Benefits of Open Banking

This new financial technology is beneficial to both businesses and customers. While fintech businesses can build innovative platforms, open banking gives the customers access to better financial services and products.

The emergence of this open technology allows startups and even independent developers to build reality-changing financial products. It also removes the monopoly that big banks have over everyone’s finances and data.

There are many benefits for customers to embrace a more open financial space. Some of them are:

- A higher number of tailored financial products

- Faster access to credit and financing

- Access to own financial data to help make better financial choices

The main goal of open banking is to accelerate the innovation of the financial sector, while prioritising consumer safety and legal compliance.

How Can Macropay Help?

Macropay offers an easy-to-comprehend open banking payment flow. Our integrated services make it easier for customers to pay with the payment method and bank of their choice.

Reach us at [email protected] to know our service better.